NFTs Were Invented 10 Years Ago This Week! Looking Back At Their Evolution and Future Outlook (#176 - 5 May 2024)

May 23, 2024

The web3 ecosystem experienced a significant milestone this week, with the 10th anniversary of the very first NFT.

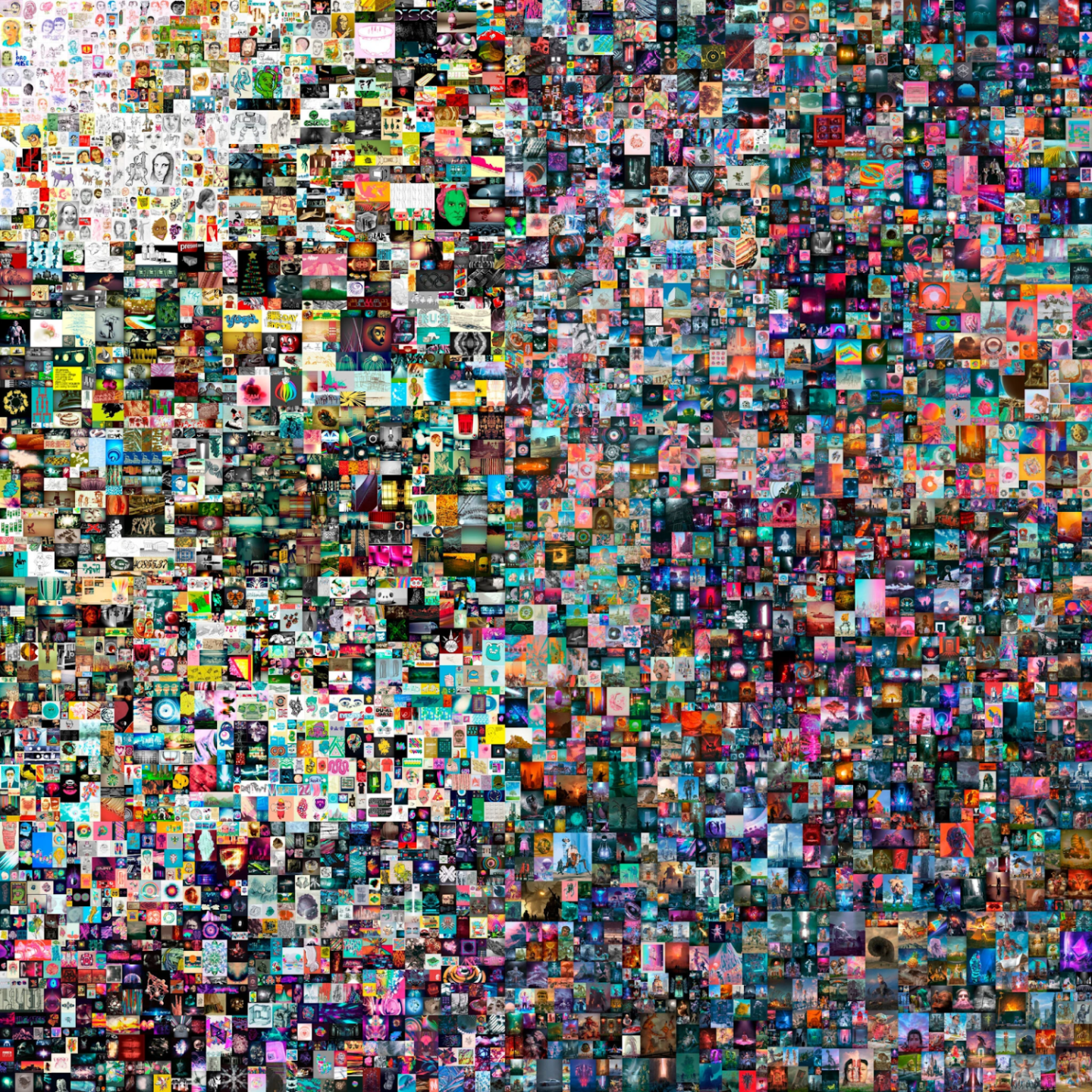

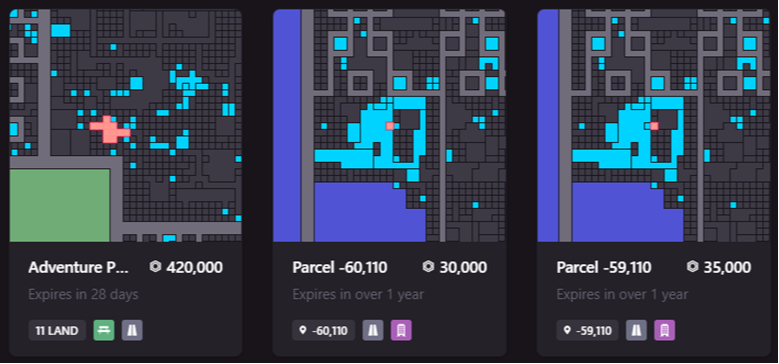

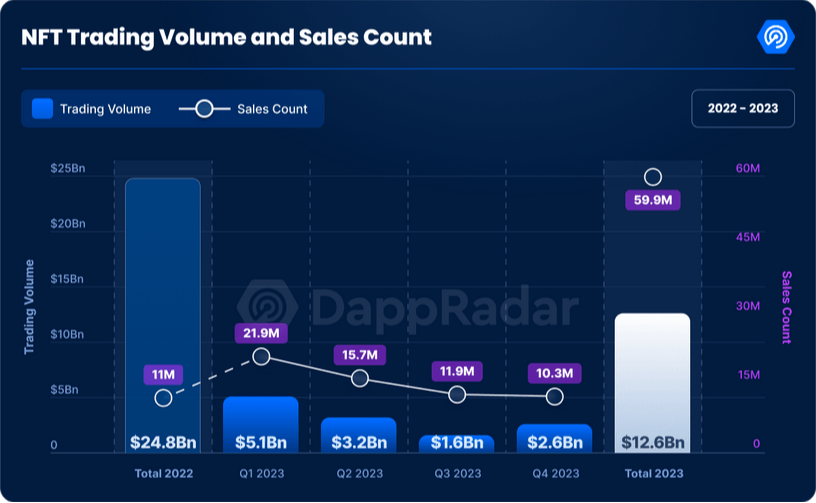

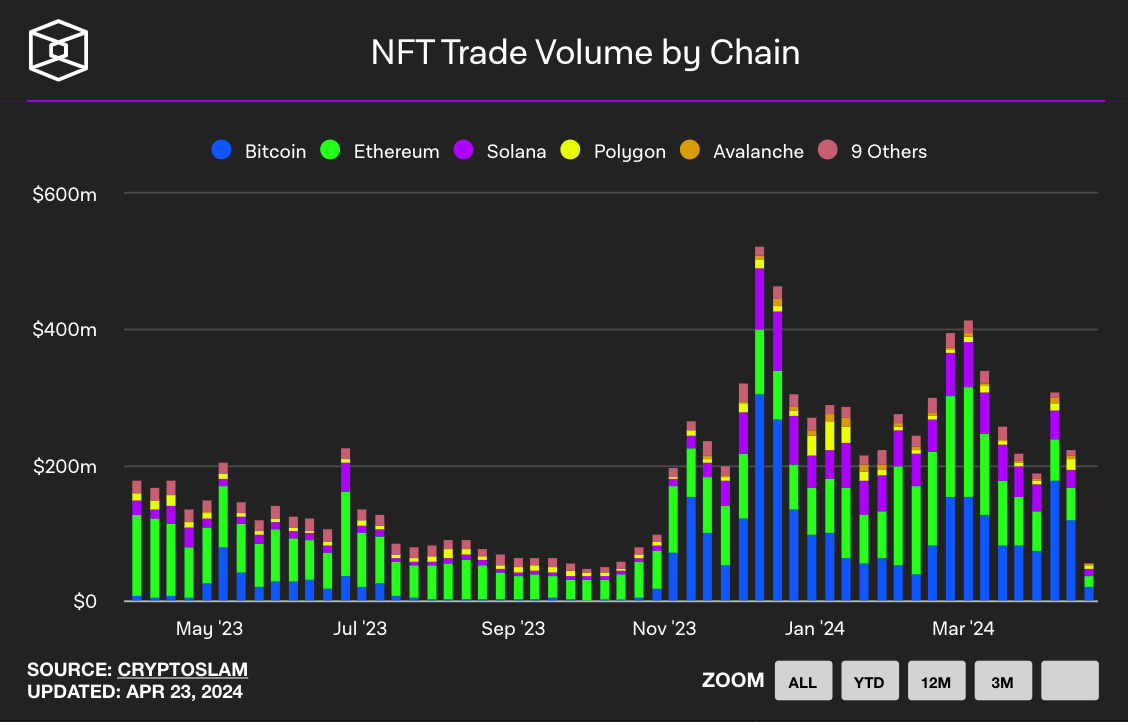

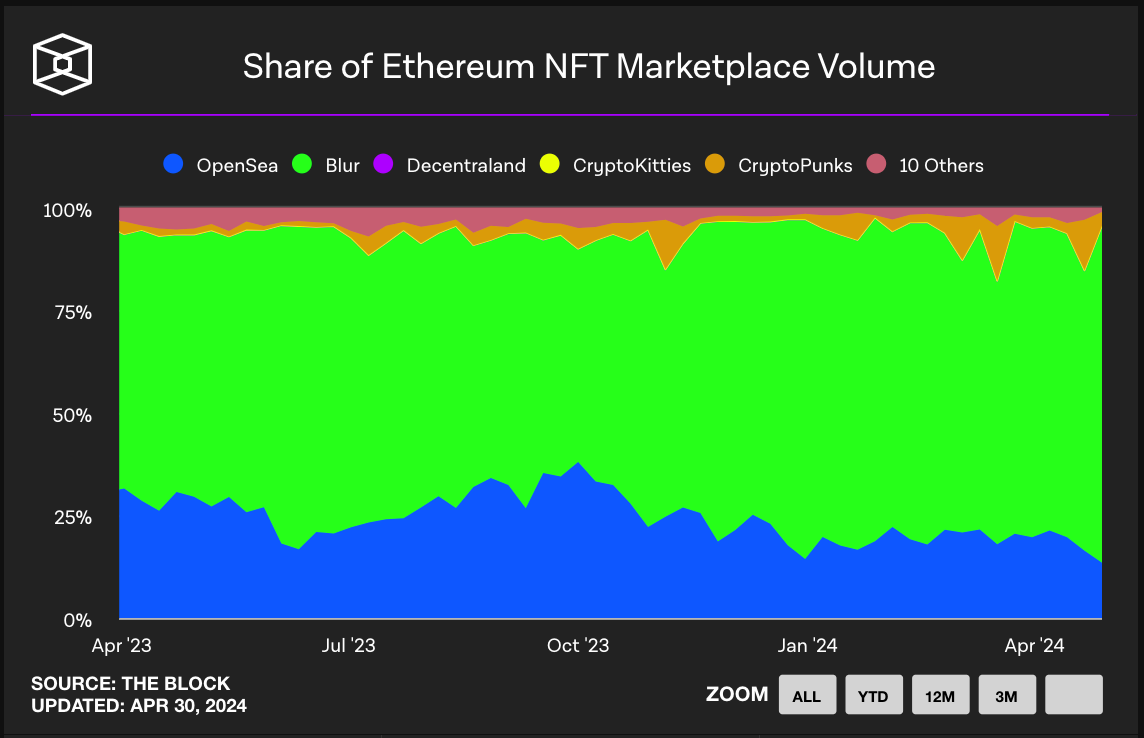

On May 3rd, 2014, years before crypto surged into mainstream consciousness, Kevin McCoy minted his pioneering non-fungible token, named “Quantum,” which features a pixelated, pulsating octagon in vivid, fluorescent colors. McCoy and fellow programmer Anil Dash had been experimenting with an early blockchain known as NameCoin, and the pair were later able to register the looping “Quantum” on the nascent platform, referring to it at the time as “monetized graphics.” “Quantum” eventually sold for US$1.47m during the height of the NFT boom in 2021 at a controversial Sotheby’s auction. Source: Sotheby's To understand how NFTs evolved from a single looping image to an almost US$70b market cap globally, it’s important to start from the beginning. Non-fungible tokens (NFTs) are unique and, as their name implies, not fungible. These tokens use the properties of blockchain technology to facilitate more transparent and enforceable scarcity of a digital asset by allowing that scarcity to be easily verified and its ownership transferable. For instance, a Bitcoin is equivalent to any other Bitcoin. Or, in the non-digital world, a $5 bill is equivalent to any other $5 bill. However, a non-fungible tradable token is unique and can be mathematically proven using blockchain technology. If you’re looking for examples, CryptoKitties, built on the Ethereum blockchain, is an excellent place to start. The game allows users to buy and ‘breed’ virtual cats, each with unique properties. When launched, CryptoKitties became so popular that they represented 25% of the traffic on the Ethereum network, which resulted in a bit of congestion! In the non-digital world, we have a vast array of non-fungible goods. Your house or a piece of art you made will likely be non-fungible. After all, your house or a painting you made is unique; no duplicates exist. The sports memorabilia industry, an industry estimated to be worth over US$5 billion a year, is a good example, with people collecting not only scarce items, like jerseys worn by certain players, but more widely available, but still rare, collectibles, like rookie sports cards. If you grew up in the 90s playing with Magic: the Gathering and Pokemon cards, some of those cards are now worth thousands of dollars. In many ways, the CryptoKitties NFTs are no different than other traditional physical or digital card sets, whether they’re a set of basketball cards, a deck of Magic the Gathering, or an old set of Pokémon cards. In each case, the cards provide value to their owner and are tradable with other card collectors. Unfortunately, in traditional centralized systems, the issuer of the cards may be tempted to debase the cards’ value. For example, they could sell many copies of a highly prized card, thereby deflating the price and making the item less rare and valuable. But nonfungible tokens on the blockchain can solve this problem, as they provide several specific attributes: There is no doubt that NFTs hit the mainstream towards the end of 2017 with the launch of the cute digital cats we discussed earlier, CryptoKitties. However, several experiments had already been taking place before CryptoKitties, like colored coins on the Bitcoin network and CryptoPunks, a set of 10,000 unique collectible characters, each with their proof of ownership on the Ethereum blockchain. The pivotal moment for the NFT ecosystem happened in early 2021 when the NFT industry exploded. Weekly NFT trade volumes on January 1, 2021 were less than US$10 million in total before climbing to almost US$200 million only six weeks later, with the number of users increasing as well, skyrocketing from under 25,000 in early January to over 500,000 only a couple of weeks later. A few things of note happened in that period: the image of a meme of an animated flying cat with a Pop-Tart body leaving a rainbow trail in its wake was sold for just under US$600,000, and a painting by the enigmatic Banksy was digitized and transformed into an NFT before being burned down. Even former Twitter CEO Jack Dorsey muscled his way into the action, selling his first tweet as an NFT for US$2.5 million at a charity auction. The catalyzing moment, meanwhile, was in March 2021, when a piece of digital art by the artist Beeple set a record for digital artwork in a sale at Christie’s, with the JPEG auctioned off for US$69.3m. Dubbed “Everydays – The First 5000 Days”, the piece is a montage-like mosaic of all the images that Beeple had been posting online since 2007. Source: Christie's What is unique in all these cases is that the art is digitally native. Unlike traditional art, where the original is on canvas, and there are digital copies, here the original is digital, and whilst we can make unlimited digital copies or even physical reproductions of that piece, there is one that is the original NFT. The other significant development was the incredible growth in popularity of NBA Top Shot, which launched in late 2020 but gained mainstream popularity in early 2021. NBA Top Shot became an incredible success story, emerging as the most popular NFT collection, attracting the highest number of users whilst almost singlehandedly steering NFTs into the mainstream, generating US$230m in sales. The basic idea of NBA Top Shot is that users can build and compile their basketball highlights collection, purchase a digital pack of 10–15-second random moments from real-world games, and get a cross between a TV reel and a traditional sports card. Source: NBA Top Shot What gives these “moments” value is that Top Shot rests on the same foundation that gives a Bitcoin value: scarcity. For instance, Top Shot highlights can range from thousands of digital copies to only one digital copy. The process behind acquiring a Top Shot pack is like going to an actual brick-and-mortar store to buy a new pair of limited-edition sneakers, with users “lining up” in a digital queue; the “first come, first served” principle reigns supreme. Once a collection sells out, that’s it. Whilst a Top Shot pack could typically go for as low as $9, these packs frequently and quickly sold out. The 2021-2022 period also saw the rise of NFT avatars and the profile picture (PFP) craze, with the aforementioned CryptoPunks popularizing the concept of owning an NFT as a profile picture in the web3 space. Source: CryptoPunks The emergence of a similar collection in Bored Ape Yacht Club only drove the NFT space to new heights, with the collection being boosted in popularity by several celebrity endorsers as well as tie-ins with notable brands. Source: Bored Ape Yacht Club CryptoPunks and Bored Ape Yacht Club played such a significant role in the development of NFTs that I covered them in their own separate issue of my newsletter, which you can read here. Over the past few years we have seen many innovative developments in this space, and several established brands have been dipping their toes into NFTs, from luxury designers to professional sports leagues. Source: Dolce & Gabbana Source: Candy.com Another NFT example worth highlighting is Decentraland, which has a finite, traversable, 3D virtual space called LAND, a non-fungible digital asset maintained in an Ethereum smart contract. LAND is divided into parcels identified by Cartesian coordinates (x,y). These 10m-by-10m parcels are permanently owned by community members and purchased using MANA, Decentraland’s native token. Source: Decentraland This gives users complete control over their environments and applications, which can range from static 3D scenes to more interactive applications or games. Source: Decentraland But since its peak in late 2021-early 2022, the NFT market has experienced a notable decline, with trading volumes falling to less than half of what it was in 2022, falling from over US$26b to under US$12b. Source: DappRadar But despite this slowdown, NFTs continue to occupy a significant portion of the active web3 space, accounting for 37% of unique active wallets in the DApp ecosystem. Much of this activity continues to take place on Ethereum, which remains the dominant platform for NFT development, holding over 80% of the market share. It’s interesting to note here, though, that a lot of energy in the NFT space has shifted towards the Bitcoin network, which began to make its mark with the launch of the new BRC20 standard in early 2023, contributing to a surge in NFT-related volumes. Source: The Block The past year has also seen a shift in marketplace dominance, with OpenSea, long the leading platform for NFT sales, being overtaken by Blur. Source: The Block In the gaming sector, blockchain games lead NFT trading volumes, with top collections like Axie Infinity and NBA Top Shot driving significant activity despite the broader market downturn of 2022-2023 affecting NFT floor prices and metaverse land values, which have seen substantial reductions. As we’ve seen, whilst the early days of NFT experimentation and most applications so far have been for collectibles or gaming, this area has quite a lot of potential and still has significant room for innovation. We’re really at the beginning of the NFT revolution, and we’re already seeing many everyday items offered as NFTs, from concert tickets and songs to birth certificates and land titles via tokenized real-world assets (RWAs). Will be very fascinating to see what the next decade of NFT innovation will bring. Found this content useful? Make sure to subscribe!