10 Lessons I Have Learned From 10 Years in the Crypto Industry (#196 - 24 November 2024)

Nov 24, 2024

This year marks my tenth anniversary in the crypto industry. Crazy, I know.

I organized my first Bitcoin event in March 2014 in Hong Kong at the Canadian Chamber of Commerce.

At the time, the chamber got complaints from members asking, “Why is Henri organizing such a money laundering event?”

The email invite for the first Bitcoin event that I organized (Bitcoin was the only coin then!) in March 2014

As I reflect on this past decade, here are ten things I have learned about this industry that can hopefully be useful to some of you who are looking to enter this industry.

Obviously, many of my points would apply to any other industry, but I think they are particularly relevant to the crypto industry.

1. Reputation Matters

Due to the recent nature of the industry, personal reputation holds an incredible weight and is perhaps your biggest asset.

Most people I currently deal with in crypto are folks I have known for many years, often across various roles in the industry.

My advice to anyone entering the industry is to always be respectful and professional regardless of your role. Don’t be an asshole if you are on the buy side. Don’t exaggerate things when you are on the sell side. Stay ethical at all times.

The crypto industry is a roller coaster; sometimes you will be up and other times down. But your reputation will follow you everywhere.

In the crypto industry, you are always one phone call away from getting a real background check on someone. Never forget that.

2. Asking For Forgiveness Is Sometimes Better Than Asking For Permission

This is probably my most unexpected personal observation. Over the past decade, I have seen the birth and growth (and failure) of most of the large crypto firms today, and I have had the privilege of knowing most founders and CEOs personally. As crypto regulations were taking shape between 2016-2018, I was a big advocate for crypto firms to be fully compliant and be whiter than white. In hindsight, I was probably wrong.

Many firms who took that approach were either over-optimistic on the speed of regulatory change or put too much weight on the importance clients put on such firms being regulated. Me being the first.

The firms that I saw thrive were those that probably operated in the quasi-grey area and then asked for forgiveness by paying a fine or eventually being regulated.

I would argue that that is not the case anymore in 2024, as there are (generally) clear regulations and market best practices. But I admit that I was probably wrong many years ago.

I delivered my first-ever TEDx talk on FinTech in 2016 in Hong Kong. It was the first TEDx talk globally on the topic. I would start my speech by explaining what FinTech is.

I have been wrong many times over the years, like here in 2017, when I believed it would be the year of crypto...

3. Accept Being Laughed At

The consensus now is that crypto is here to stay. But that was not the case a decade ago.

I vividly remember the day Mt. Gox collapsed in 2014 and even I doubted that the industry would survive. It was way more mainstream to disregard crypto and laugh at the people who were involved in it.

For example, I was already an active member of the crypto “speaking circuit” as of 2015, and I was often invited to dinners and events to be, in practice, laughed at.

I vividly remember a large Blackrock event in Hong Kong where I was (to their admission) put at a table with CEOs so that they could be entertained about this fad and have a lively dinner with the “Bitcoin guy.” Today, Blackrock owns the largest Bitcoin ETFs globally, and their management is now all pro-Bitcoin.

I remember another dinner at a private club in Hong Kong by Citibank, where the hosts spent the evening making fun of me and explaining how Bitcoin was like the Tulip Mania.

I also recall sending an email in 2014 to my UBS colleagues during my investment banking days about Bitcoin and blockchain and how this could impact the future of finance before having a Managing Director tell me to stop sharing such stupidities as it would negatively affect my career.

And I also remember talking to a Bloomberg producer in 2015 or 2016 during the holiday season as I was getting ready to go on air to talk about this “Bitcoin thing.” I told her that one day, there would be a TV show dedicated to crypto. She turned around and said: “Henri, my kids also believe in Santa Claus.” And the folks in the studio all laughed. I also laughed along, but it really hurt me. I have been thinking about reaching out to her now, 10 years later, and telling her that I finally have my own crypto show on CNBC Arabia that is seen by 60 million people weekly.

The list of such events goes on, and I am thinking of publishing some of these stories one day.

But being laughed at is something you get used to in this industry. The truth is whilst you learn to accept these moments, you never fully get used to them. It's life, and it is what it is.

Talking about Bitcoin at a BlackRock event in Hong Kong in 2017

Speaking at a Credit Suisse event in early 2017. The feedback we would often get was that Bitcoin would simply die. We all saw how that turned out.

4. Beware of the Flamboyant

Over the years, I have learned that anyone or firm in crypto who acts flamboyantly, from the Lamborghinis and yachts to the models and champagne, is a massive red flag.

My speaking agent knows that I never speak at an event where there are Lambos or girls in mini-skirts at the entrance. In Dubai, I stay away from what I call the “Dubai Marina crypto crowd” or any of those “yacht parties.”

I have so many stories from crypto parties, from one where the hosts invited dozens of escorts to make the crypto bros feel like rock stars to launch parties so over the top that they would make hip-hop stars look like classical musicians.

My experience in crypto has shown that when individuals or firms try to act so flamboyantly, they are hiding something. If you are attracted to the crypto industry because of the Lambos, parties or girls, you should probably stay away.

5. Be Humble

Everyone works hard in the industry. But luck plays a big role. I have seen entrepreneurs who worked equally hard with equally good ideas, but where some got lucky, others did not.

For example, my guest at my first ever Bitcoin event in 2014 was Aurelien Menant, the founder of Gatecoin, the first crypto exchange globally to list Ethereum. He opted to build his business by being above board and reaching out to regulators, but banks would regularly shut down his accounts, and regulators would not listen to him. His exchange would eventually get hacked and shut down.

At the same time, in Hong Kong, other firms were set up that were doing the same thing (and were, in practice, operating in the grey area) and are now worth hundreds of millions of dollars.

I remember one of my clients at PwC who basically was pioneering NFTs before they were a thing. Unlike many of the idiots we regularly see in the NFT space now, that team were true pioneers and literally risked everything they owned for their business. But they were too early. Then others came only months later, with a fraction of the talent or vision, and became very successful.

I have seen this pattern over and over in all crypto verticals. Talent and skills definitely play a big role, but luck plays an outsized role. Never forget that.

Aurelian Menant speaking to my HKU students in 2015 about Bitcoin (interesting how this slide would look different now). His exchange, Gatecoin, would be the first one to list Ethereum. I owe a lot of my early interest in Bitcoin to him.

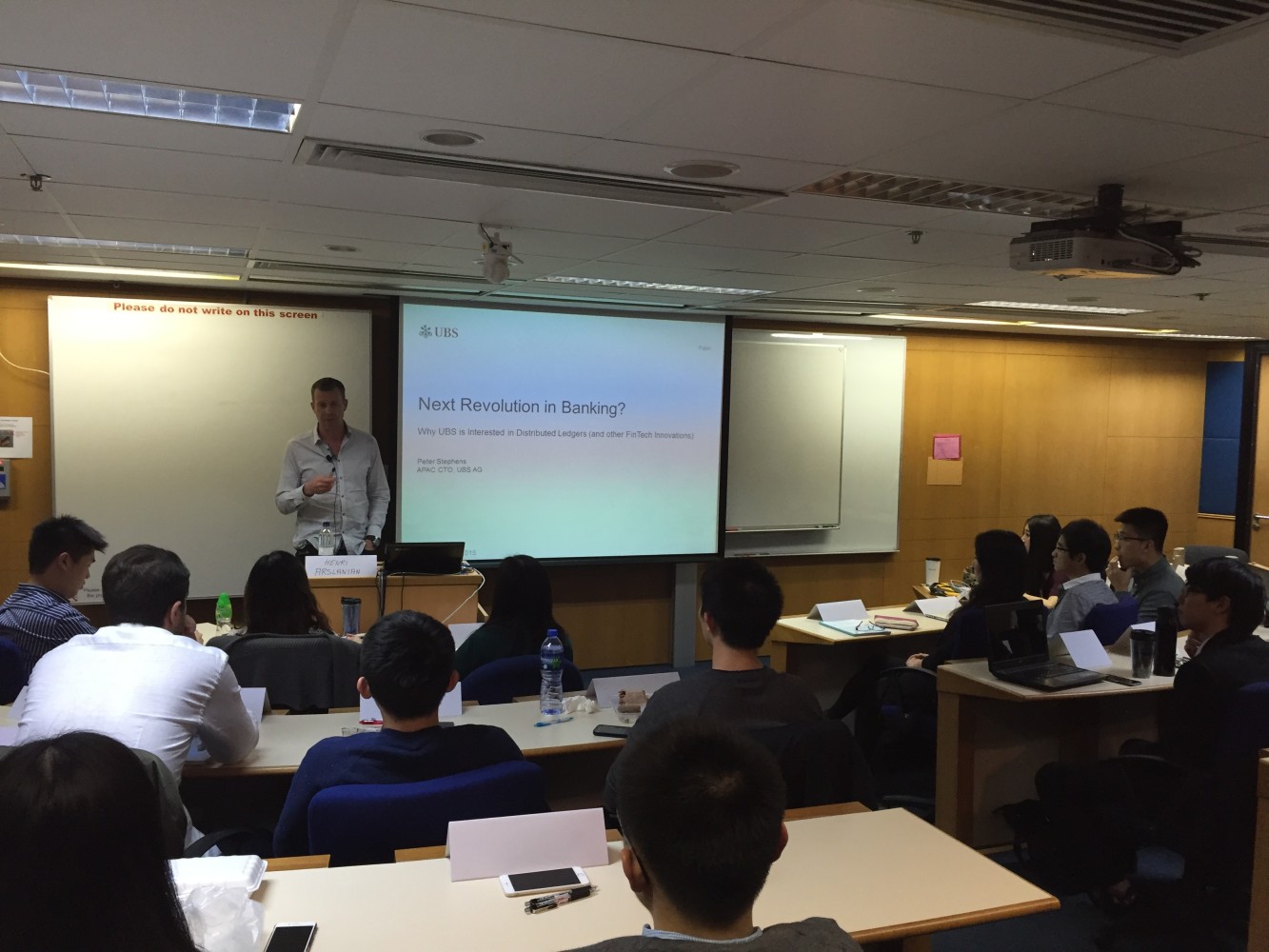

I have been teaching crypto since 2015 at HKU. One of my first guest speakers was my then-UBS colleague Pete Stephens, who was pushing blockchain within UBS and shared a session on "Why UBS is interested in DLT." I guess UBS is still exploring...

China was a bug hub for crypto before the ban. I remember this event taking place in Shanghai literally in the days after the ban. I had to change my entire keynote overnight from "The Latest Global Crypto Trends" to "RegTech on the Blockchain"!

6. Be Respectful

I have also learned to respect those who play an outsized role in the development of the industry but without the personal upside.

For example, almost all of the staff at Dubai’s new crypto regulator, VARA, could get a job tomorrow in any crypto firm and get paid double what they make now, probably working half as much. However, most stay as they believe in building the crypto regulatory framework of the future of finance. The same goes for those who spend time creating educational content, teaching crypto, or running industry associations.

I remember one entrepreneur in 2018 who sold all of his Bitcoin to be able to finance an event around the G20 in Japan where the goal was to create awareness about the industry to regulators and policymakers. There was zero upside for him. But he was doing it for the greater good of the crypto ecosystem. This is something you would never see in traditional finance.

I have dozens of such examples. For example, the outsized role that the Bitcoin Association of Hong Kong played in the early days of crypto and indirectly catalyzed the birth of many of the leading companies we know today.

Much of what we have gained in the crypto industry comes from people like them. Never forget that and respect these individuals.

Launch of the FinTech Association of HK, for which I had the honor of serving as its first Chairman. The FTAHK contributed greatly to the growth of the crypto ecosystem in HK and Asia.

I owe a lot of my initial success in building the PwC crypto team to Jehan Chu, who referred me to some of my first clients. Here I am interviewing him for one of my first-ever social media interviews.

7. Stay Away from Scammers and Respect Those Chasing Them

I have also had the privilege of working with law enforcement and regulators over the years as we tried to get rid of bad apples that give our industry a bad name.

Many of these individuals then moved to the other side to help crypto firms clean things up. My friend Tigran Gambaryan, who previously was a special agent with the IRS chasing crypto criminals and who ended up being illegally held in a Nigerian prison for eight months due to being an employee of Binance, is a good example. I have tremendous respect for such individuals and will always do.

Many of us have advocated for basic compliance to keep the bad apples out of the industry. I remember giving a keynote in early 2017 at one of the first large ICO events in Hong Kong, where I advocated for token projects to do basic KYC and AML to understand who the folks buying their tokens were. I got boos from the audience. But we need to have basic guardrails, or else only a couple of bad apples can bring the industry down.

Due to my large social media footprint, I also have to deal with impersonators every week who are trying to scam my followers. I also get approached by many scam projects each month, offering me to pump a specific token in exchange for a percentage of profits. Of course, I turn these down, but the fact that such firms are so open about this shows you how present such scams still are.

Stay away from such folks and from anyone who promises you to make a quick buck.

First offsite of my PwC Crypto, which I would go on to lead globally. Many of the (then younger!) folks in this image would go on to become partners or join amazing crypto businesses.

8. Listen

Over the years, I have learned to spend more time listening to those who don’t believe in crypto rather than those trying to preach the Bitcoin or crypto gospel.

This is particularly the case when I meet with central bankers, regulators or leaders of traditional banks. I have found that in crypto, we often get stuck in our echo chamber and don’t spend enough time listening. No, blockchain does not save all the problems of the world. No, web3 will not solve all the issues of web2.

We should sometimes take a step back and realize that the global innovation puzzle is much, much bigger than the crypto one, and we should learn to be humble, listen, and try to understand the other side.

Then, you can learn how to present targeted, reasonable, and intelligent arguments about why Bitcoin and crypto matter.

I wish more in our crypto ecosystem would do this.

Group picture of one of my first HKU courses on FinTech and crypto. Each year, many students would leave their TradFi jobs to join the FinTech/crypto world. This year was no exception.

Speaking at a central bank-organized event in HK. The city was a perfect hub for innovation, with financial expertise, entrepreneurship, and capital all coming together.

9. Respect the Builders

Launching and growing a crypto firm is not easy. In addition to all the challenges of any start-up, the problem in crypto is that you are treated like a de facto criminal.

I vividly remember how a large bank in Hong Kong would systematically close down the bank accounts of any firm that touched crypto and that of its founders with 30 days' notice.

Another sizeable global bank tried to close my account once in Dubai as I was a “PwC partner in charge of crypto.” They only backed off when I was able to escalate and show that I was featured on the cover of a global research piece issued by their research team that same week about crypto (the irony).

I have been in dozens of conversations over the years with founders who literally had 2-3 weeks of cash left but had to wake up in the morning and try to win business and motivate their teams.

I have dozens of similar stories that should go in a memoir one day. But what all crypto builders have in common is a genuine belief in the industry, and that is very commendable and something you don’t find easily in other industries.

An event organized by a client of mine (Fluidity - which would go on to be acquired by Consensys). These were the good days of crypto in the U.S., with everyone gathering once a year in NY for Consensus.

10. Embrace Bear Markets

Bear markets are when the FOMO goes out the window, and only those who genuinely believe in the industry stay.

Anyone who has stayed in crypto during a bear market (especially the latest 2023 post-FTX bear market) will likely remain in the industry for the rest of their career.

These are the people you should spend time building a relationship with. For example, returning to TradFi after someone has tasted the fast-moving pace of crypto is almost impossible.

Crypto is a bit like Hotel California: you can check out anytime you want, but you can never leave.

And this is something beautiful.

Hope the above was useful. Keen to hear your feedback.

Make sure to also follow me on X or YouTube so as not to miss my latest content.

One of the best initiatives in Hong Kong was when the Bitcoin Association of HK and many other friends of Bitcoin sponsored trams and banners on Bitcoin across the city. I have this image of this tram in my office now.

Extra: How did I discover Bitcoin and crypto?

I first learned of Bitcoin in 2013.

At the time, I was living in Hong Kong and working for the Swiss investment bank UBS. I was already very passionate about the future of finance, the changes that were starting to disrupt finance, and what would then be known as FinTech.

As one of my many “side roles,” I was also the President of the Armenian Community of Hong Kong and China. In late 2013, we were revamping our website, and my volunteer CTO was a fellow Armenian living in Hong Kong named Raffi.

Unbeknownst to me, he’d been mining Bitcoin since 2011, when Bitcoin was $30, before selling them when the price hit $300, thinking he had done great by multiplying his investment by 10 in a matter of months. At the end of a phone call with developers for our new website, he asked them if they accepted Bitcoin.

I remember being angry with him, as I thought it was a stupid question, but it made me curious, and I started researching the topic. I wanted to know whether others were also interested in Bitcoin and were at least as curious as I was.

An opportunity would arise a few weeks later, in January 2014, after reading an article in Hong Kong’s South China Morning Post newspaper about the young French banker Aurelien Menant, who had just left a French investment bank to launch one of Hong Kong’s first crypto exchanges, Gatecoin.

I got in touch with Aurelien, and we met for coffee in Hong Kong’s iconic IFC building. We hit it off and agreed that more people needed to hear about Bitcoin.

I was then co-chair of the Financial Services Committee of the Canadian Chamber of Commerce in Hong Kong. I used that opportunity to organize an event in March 2014 called “Bitcoin: Disrupting Financial Transfers,” where I invited Aurelien to be a guest speaker (in his first-ever public keynote).

I had fallen into the crypto rabbit hole and have been passionate about space since then. I left UBS in 2015 to focus exclusively on FinTech and have been professionally focused 100% on crypto since 2016 when I launched the crypto team at PwC (which is another story altogether).

—

Excited to announce the launch of my new kids’ book!

The first interactive children's book on the future of money and digital assets!

Published by Brown Books Kids and available on Amazon (https://a.co/d/1xp9wEc) or the Henri and Hodler website (www.henriandhodler.com)

—

Join My WhatsApp Community

Interested in getting daily curated crypto news updates and hearing my point of view on major developments?

You can join my WhatsApp Announcement Group community here.

Enjoyed this content? Make sure to subscribe or share it with a friend! A new Future of Money newsletter will be in your inbox each week!

See you all next week!!

Henri Arslanian

*Please note that this newsletter reflects Henri’s personal views and not those of any organisation he is involved with. This newsletter is for educational purposes only, and none of its content should be construed as investment or financial advice of any kind.

Who is Henri?

Henri Arslanian is the co-founder and managing partner of Nine Blocks Capital Management, an institutional-grade hedge fund focused exclusively on digital assets, with a market-neutral crypto fund focused on generating alpha from inefficiencies in crypto markets using relative value, arbitrage, and quantitative strategies.

Henri was previously a partner and global crypto leader at PwC. In that role, he advised many of the world’s leading crypto exchanges, investors, financial institutions, and tech firms on their crypto initiatives and numerous governments, regulators, and central banks on crypto regulatory and policy matters.

With over 500,000 LinkedIn followers, Henri is a TEDx and global keynote speaker, a best-selling published author, and is regularly featured in global media, including Bloomberg, CNBC, CNN, BBC, The Wall Street Journal, The Economist, and the Financial Times.

Henri was named by LinkedIn as one of the 2022 global Top Voices in Finance and is the host of the CryptoCapsules™ social media video series as well as The Future of Money podcast and newsletter.